In today’s global economy, cross-border payments have become common practice for individuals and businesses. Millions of money transfer transactions between millions of countries take place every day. The realization of sending money transactions and the accuracy of the international bank account number (IBAN) is very important to prevent many disruptions. In today’s technologies, many money transfer applications use IBAN checker API for this. This is also known as the IBAN lookup API.

The use of an IBAN checker API has eliminated costly errors and delays for many businesses. For this reason, it has a critical role in businesses. In this article, we will look closer at the importance of an IBAN checker API in payment transactions. But first, let’s look at what an IBAN is and how it is structured.

What is an IBAN (International Bank Account Number)?

IBAN (International Bank Account Number) is an account number used in international money transfers. The IBAN is used to identify the recipient’s bank account. It includes the recipient’s bank, bank code, account number, and other information. IBAN helps send money faster and more securely because the recipient’s bank account is defined according to international standards.

Most European banks require an IBAN today to send or receive money. IBAN is also a verification method to prevent the use of incorrect account numbers or bank information.

In general, the format of the IBAN may vary from country to country, but creating it according to the ISO 13616 standard is necessary.

For example, IBAN numbers in Turkey are 26 characters long and have the following format:

IBAN example: TRkk bbbb bccc cccc cccc cccc cc

Here, “TR” represents the country code, “k” the check digit, “b” the bank code, and “c” the last characters of the account number.

What is the Importance of IBAN Lookup in Payment Transactions?

Using an IBAN lookup is crucial for applications that involve sending money. It verifies that users have accurately entered the IBANs to which they intend to transfer funds. The long and intricate format of IBAN varies from country to country. It can easily lead to mistakes when entering it. Transferring money to the wrong account or bank may result in a loss of money or delays due to an incorrect IBAN.

The IBAN checker verifies that the IBAN is in the proper format, that the country code is correct, and that the check digit is calculated correctly. This prevents the use of incorrect IBANs and guarantees that money transfers reach the appropriate accounts and banks. Moreover, the IBAN checker provides a faster, more dependable method of transferring funds by preventing human errors.

Online banking applications are among the most popular applications using the IBAN checker.

Bank Data API: Best Way to International Money Transfer from IBAN to Bank

Bank Data API is an API that enables applications that carry out money transfers to perform validation from a single point. Its core service is a validation of IBAN and SWIFT numbers. But it is more than an IBAN checker API by providing multiple endpoints.

It allows companies that handle financial transactions and financial service providers to verify their bank accounts and check their customers’ bank accounts. In addition to validation services, it provides many services, such as accurate and up-to-date local bank details, country-specific IBAN structures, and generating sample IBANs.

Integrating Bank Data API into all programming languages is easy—Java, Golang, JavaScript, PHP, C#, Ruby, and more. The REST API it provides contains detailed information.

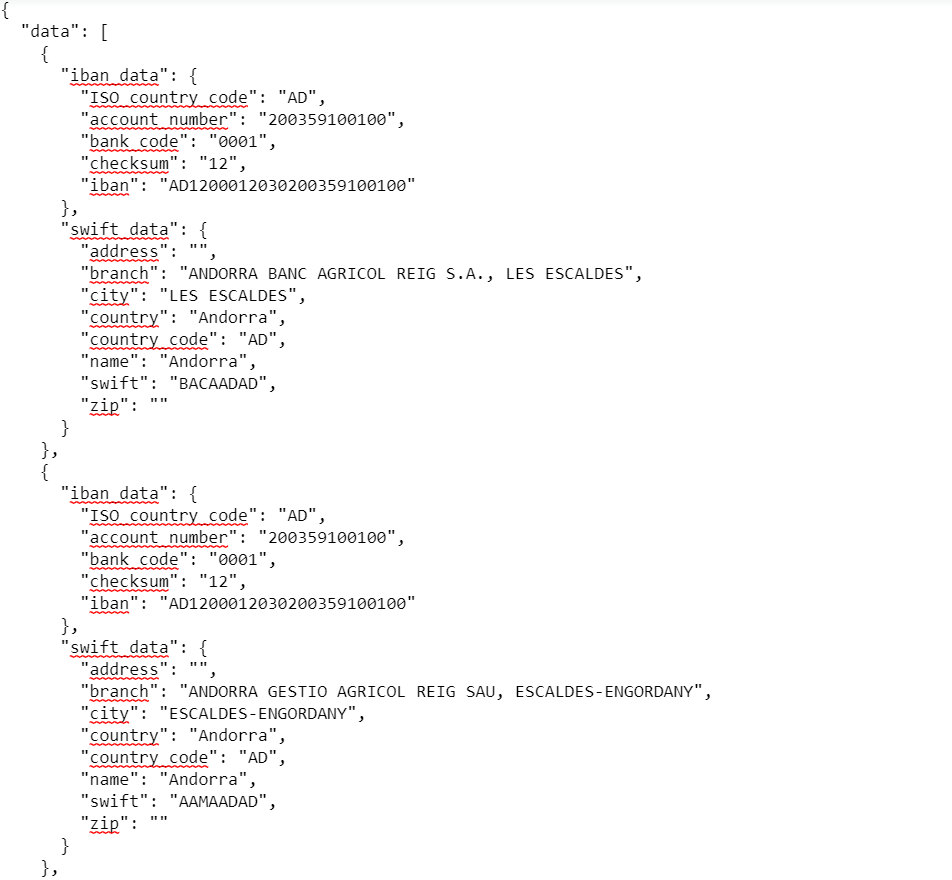

For example, the JSON output of the endpoint of major banks that returns the SWIFT and IBANs is as follows.

What are the Subscription Plans of the Bank Data API?

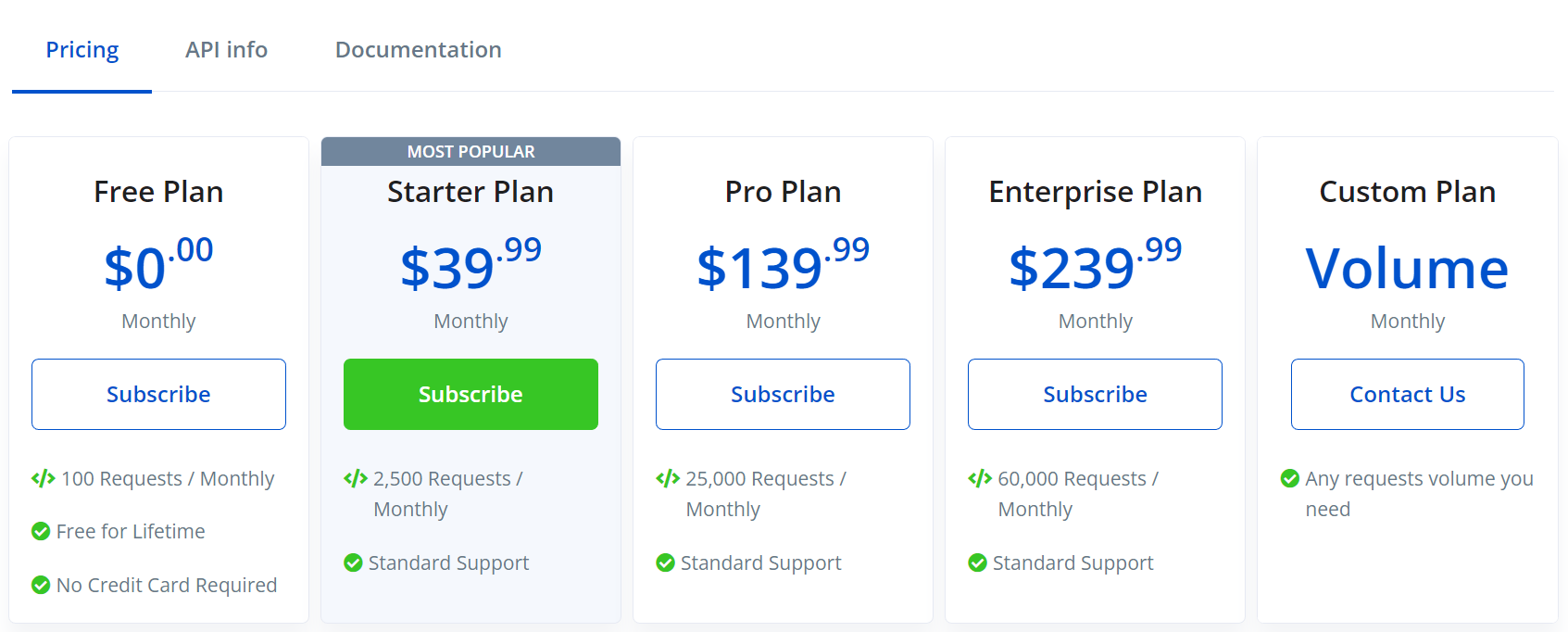

One of the primary reasons why Bank Data API is today’s most popular IBAN checker API is that it is a complete price-performance product.

This API offers businesses and individual developers many affordable and content-rich subscription plans.

- The first plan offered by Bank Data API is the ‘Free Plan.’ With this plan, users can use up to 100 requests per month without paying any fee or entering any credit card.

- The other plan is Bank Data API’s most popular plan. Many businesses and developers use the ‘Starter Plan’ today, which is only $39.99 for 2,500 requests per month.

- The third plan is the ‘Pro Plan.’ It is one of the most content-rich plans. It provides 25,000 requests per month, and its price is only $139.99 per month.

- The last paid plan is the ‘Enterprise Plan.’ This plan, which offers 60,000 requests per month to its users, costs $239.99 per month.

- In addition, Bank Data API provides the ‘Custom Plan’ option. With this option, users can create flexible plans with as many requests as they need.

Finally, Bank Data API provides an excellent interface to test this API after signing up for a subscription plan. You can try all endpoints of this API easily and quickly with the ‘Live Demo’ button on the page of this API by seeing code samples and parameter descriptions for many programming languages.

Conclusion

As a result, using an IBAN checker is of great importance for many applications where money transfers are made. In particular, preventing users from entering incorrect IBANs both increases the user experience and prevents delays directly. This also improves user satisfaction and enables new users to join the applications.

Use Bank Data API to avoid errors in money transfers. Reduce the risk to zero.

FAQs

Q: What is BBAN (Basic Bank Account Number)?

A: BBAN (Basic Bank Account Number) is an account number creation system used by financial institutions that determine and identify customers’ account numbers at the national level. A BBAN usually includes sections such as bank code, branch code, and account number. It is also used in the creation of the IBAN. It identifies that financial institution and the customer of that financial institution.

Q: What is the IBAN Format Structure?

A: IBAN is an account number format and includes different parts such as a country code, check digit, bank code, and account number. Although the IBAN format differs between countries, it must be created in accordance with the ISO 13616 standard. This standard has been set to ensure the correct processing of international money transfers.

Q: How to Validate IBANs (International Bank Account Numbers) as Best Practice?

A: There are many ways to validate IBANs. The structure of IBANs may vary for each country. For this reason, there may be more than one possibility for validation. Global validation of IBANs is now possible through IBAN lookup APIs.

Q: Is Bank Data API a free IBAN Lookup API?

A: Yes, it is free. There is a ‘Free’ plan for free among the Bank Data API affordable subscription plans. 100 requests per month are free under this plan.

Q: Can Major Bank Details be Accessed with Bank DATA API?

A: Yes, it is accessible. Bank Data API provides the details of major banks worldwide with its endpoint. These details include various information such as SWIFT address and bank code.

0 Comments